5 Altcoins That Can Make You a Millionaire in 2021

Buy these before they skyrocket

Analtcoin, or alternative coin, refers to any cryptocurrency that isn’t Bitcoin, such as Ethereum and Litecoin. The price of Bitcoin has been skyrocketing lately and it’s pulling up many other cryptocurrencies with it.

Why has Bitcoin been rising in price?

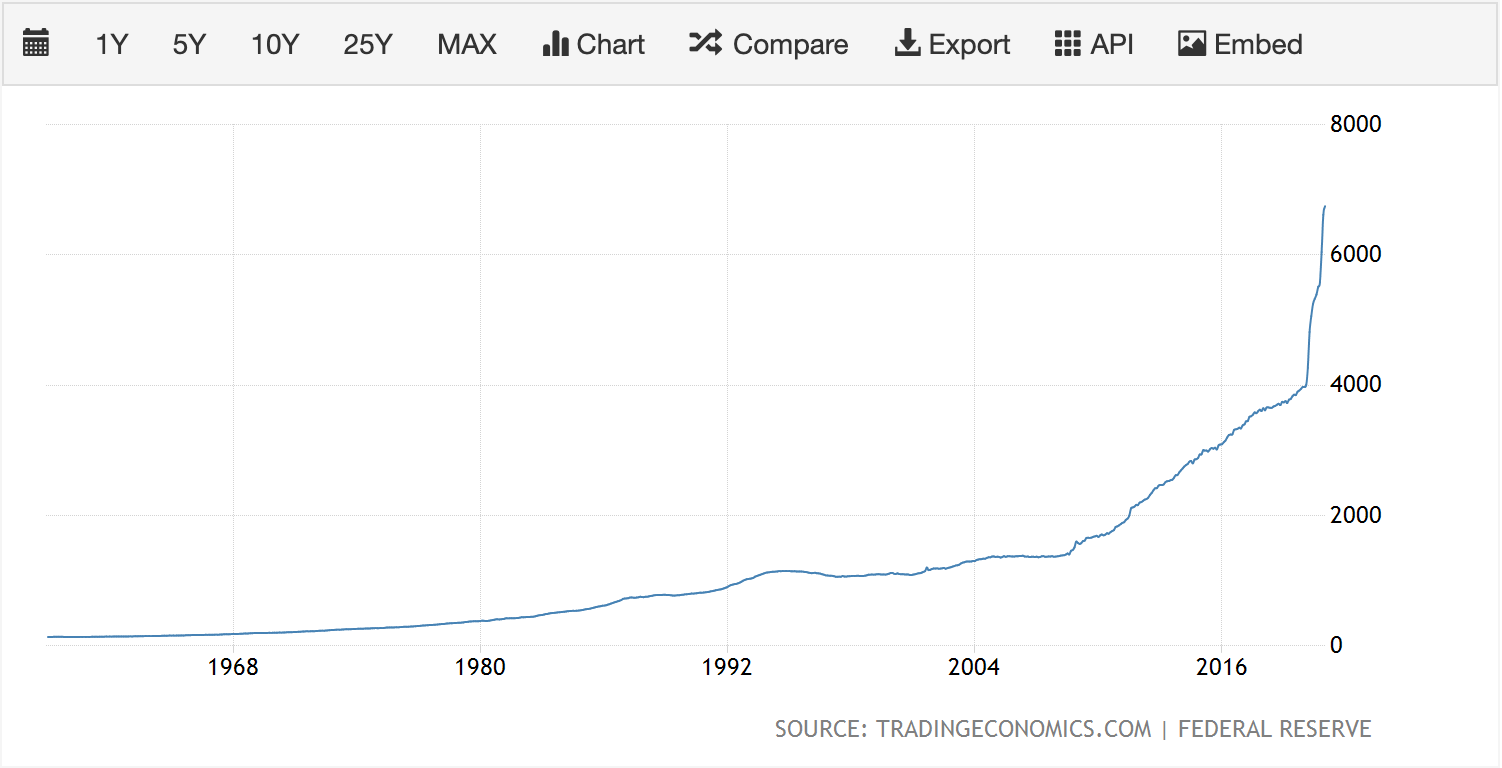

One major reason is inflation and the lowering purchasing power of the US dollar. Before the coronavirus hit, the total money supply was $4 trillion as of March 9, 2020. Since then, the total money supply has risen to $6.5 trillion. With more money to spend, the price of Bitcoin rises.

Billionaire investors and large institutions are now viewing cryptocurrency as a viable investment. For example, PayPal is launching a new crypto service that allows many merchants to accept digital assets as payment. Tesla bought $1.5 billion in Bitcoin and plans to use it to accept payment as well.

I could write an entire book on the reasons the crypto market is so bullish. Speaking of books, here’s an amazing book that discusses the various ways that blockchain technology is changing the future of money, transactions, and business.

The time to get into crypto is now. But which ones should you invest in now? Here is a list of the top 5 altcoins that will create new millionaires in 2021.

1. Ethereum (ETH)

The first altcoin on my list, Ethereum, is a global, decentralized platform for smart contracts and a new kind of application called dApps (Decentralized Applications). These apps can be run without downtime, fraud, or interference from third parties.

The digital economy built by this community is booming and allows anyone in the world to use it if they have an internet connection. A few goals of Ethereum are banking for everyone (this is huge as some people don’t have access to bank accounts depending on where they live), peer-to-peer networking, resistance to censorship, commerce guarantee, internet privacy, and more.

In 2021, Ethereum plans to change its algorithm from proof-of-work to proof-of-stake. This is will improve transaction speed and reduce energy costs. Another benefit of proof-of-stake is that it’ll allow network participants to “stake” their Ethereum to the network. Staking is like crypto mining (proof-of-work) in the sense that it helps a network achieve consensus, but it has the benefit of rewarding those who take part.

As this change rolls out, crypto experts predict that the price of ETH will skyrocket. Many predict the price will be above $4000 by the end of 2021.

As of February 19, 2021, Ethereum has a market cap of $224 billion, a circulating supply of 114,742,826 ETH, and a value of $1956

2. Cardano (ADA)

If you’ve done any research on altcoins, it’s likely that you’ve heard about Cardano. Similar to ETH, Cardano offers a public blockchain platform for smart contracts and dApps. It provides unparalleled security and sustainability to dApps.

The project was co-founded by Charles Hoskinson (one of the creators of Ethereum). He disagreed with the direction Ethereum was taking and decided to create his own cryptocurrency. That being said, Cardano is still in its early stages and dubbed to be the “Ethereum killer” as it will soon be able to do everything Ethereum does, but better.

Cardano is the first blockchain to implement the Ouroboros protocol, which enables the network’s decentralization and allows it to sustainably scale to global requirements without compromising security.

Another important upcoming milestone is the launch of the Cardano Goguen Mainnet. This will transform Cardano into a so-called multi-asset network. This will make it possible to build smart contract applications and tokens on Cardano. On top of that, decentralized finance (DeFi) protocols and non-fungible tokens (NFT) will be able to use the Cardano blockchain. This gives Cardano an advantage over Ethereum as these applications won’t be restricted by high transaction times/costs.

As of February 19, 2021, Cardano has a market cap of $32 billion, a circulating supply of 31,112,484,646 ADA, and a value of $1.05

3. Polkadot (DOT)

Polkadot promises to deliver the most robust platform for security, scalability, and innovation. What makes Polkadot unique is its aim at allowing interoperability between other blockchains. This will enable cross-blockchain transfers of any type of data or asset, not just tokens.

Gavin Wood created Polkadot (another one of Ethereum’s creators who disagreed with the direction of the project).

Unlike Ethereum and Cardano, developers won’t be able to create dApps on Polkadot. Instead, they’ll be able to create their own blockchain while using the security that Polkadot’s chain provides. They describe this as shared security.

Polkadot intends token holders to have complete control over the protocol. And not only does it allow for staking, but it allows new parachains to be added by bonding tokens.

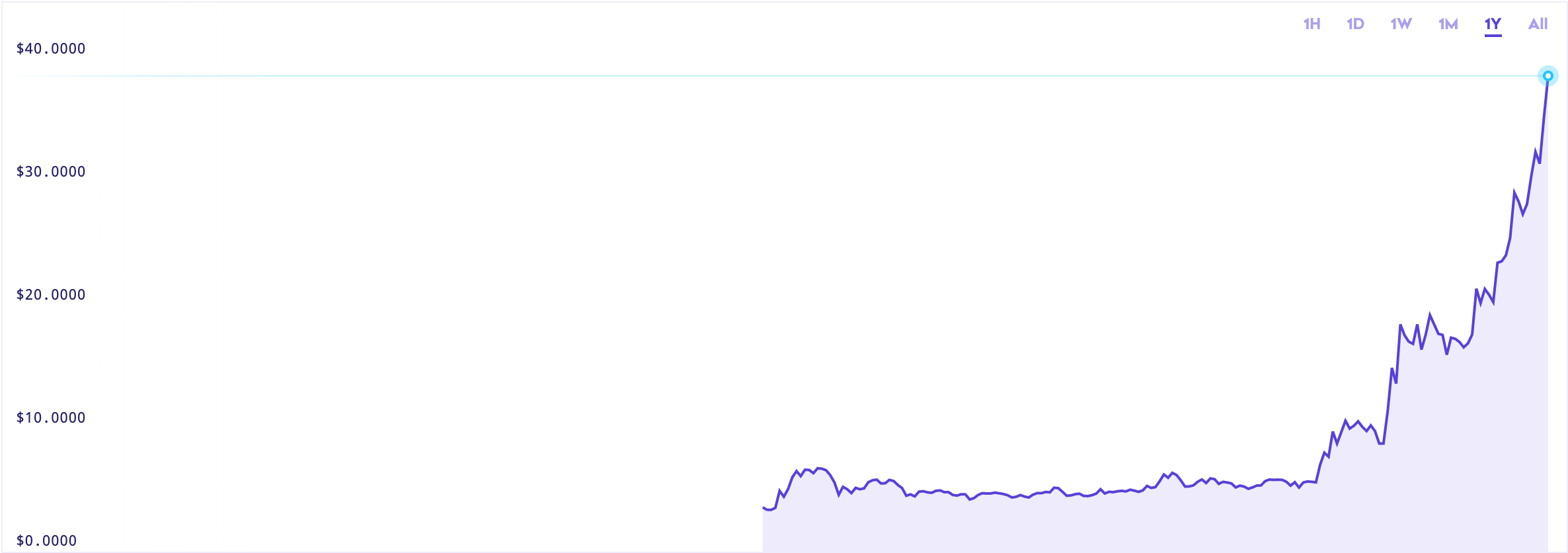

As of February 19, 2021, Polkadot has a market cap of $34 billion, a circulating supply of 909,722,905 DOT, and a value of $37.99

4. Chainlink (LINK)

Chainlink is an industry standard oracle network that greatly expands the capability of smart contracts by enabling access to real-world data, payments, events, and more. It does this without sacrificing security or reliability.

Chainlink provides transparency by allowing anyone to monitor and verify its open-source code, the quality of individual node operators, and the performance of its oracle networks.

The use cases for Chainlink are never-ending. For example, PingNET (a decentralized transmission network for IoT devices) uses Chainlink to enable automated payments between stakeholders. Blocksolid came up with a way to use Chainlink to hold Internet Service Providers accountable for faulty internet services in developing regions.

As of February 19, 2021, Chainlink has a market cap of $14 billion, a circulating supply of 407,009,556 LINK, and a value of $34.72

5. Cosmos (ATOM)

Cosmos claims to be the most powerful ecosystem of connected blockchains. It focuses on the problem of scalability that many other blockchains face. A lot of coins, such as Bitcoin, keep a public ledger that adds new data with each transaction. To maintain accuracy, the chain’s old data can never be deleted, making the chain bigger and bigger. This causes slow transaction speeds.

Cosmos fixes this issue by connecting multiple blockchains to combine their power. With this power, projects can scale quicker and easier no matter how much data is added.

The goal of Cosmos is to create an “internet of blockchains.” The deployment of the Tendermint’s Byzantine fault-tolerant consensus pool and the Inter-Blockchain Communication protocol allows developers to build across blockchains while retaining the sovereignty of each chain.

As of February 19, 2021, Cosmos has a market cap of $5 billion, a circulating supply of 210,551,050 ATOM, and a value of $23.96

Well, that’s it!

If you like this article, read more from Wealth Lovers!

Which altcoins do you believe are going to explode this year? Let me know in the comments below!

0 comments: